by Kate Evert | May 30, 2018 | Compensation, Economy, Wage Increases

Two summers ago, we posted an article, “

Is the Economy Getting Better Or Worse?” Still perplexed, this year, we’re hearing from the Kansas City Fed. They strike a cautionary note that if 14.3% of workers haven’t received a raise in the last year, then there aren’t true pressures on wages, and therefore no concerns about inflation, and no need to raise interest rates. QED.

Not so fast. Let us return to the thought process that geometry proofs taught us:

If 14.3% of workers did not receive a wage increase, 85.7% did. Drop to the median, not of the triangle, but of the same Fed statistics. The median wage increase in April was 3.3% and the 75th percentile increase of 13.9%. That delta is 10.6%

So the real question is: Who are the 14.3%? Are they people in jobs that the market no longer rewards? Are they people who have been making at market, or higher, for many years and therefore their employers cannot justify an increase? Are they employees who have not acquired new skills and therefore are stagnated in roles and cannot get a raise? Do they work for companies that are facing economic challenges and doing their best to keep their doors open in the US? Or are keeping wages low but providing benefits?

We, of course, do not have the answers to the questions underlying the 14.3%, but we feel that the focus should be on the reciprocal, the 85.7% … and especially the 13.9%. Where they live and what they do – the intersections of those planes will have far more to do with inflation.

Read More Here.

by Kate Evert | May 30, 2018 | Compensation, Economy, Wage Increases

Two summers ago, we posted an article, “

Is the Economy Getting Better Or Worse?” Still perplexed, this year, we’re hearing from the Kansas City Fed. They strike a cautionary note that if 14.3% of workers haven’t received a raise in the last year, then there aren’t true pressures on wages, and therefore no concerns about inflation, and no need to raise interest rates. QED.

Not so fast. Let us return to the thought process that geometry proofs taught us:

If 14.3% of workers did not receive a wage increase, 85.7% did. Drop to the median, not of the triangle, but of the same Fed statistics. The median wage increase in April was 3.3% and the 75th percentile increase of 13.9%. That delta is 10.6%

So the real question is: Who are the 14.3%? Are they people in jobs that the market no longer rewards? Are they people who have been making at market, or higher, for many years and therefore their employers cannot justify an increase? Are they employees who have not acquired new skills and therefore are stagnated in roles and cannot get a raise? Do they work for companies that are facing economic challenges and doing their best to keep their doors open in the US? Or are keeping wages low but providing benefits?

We, of course, do not have the answers to the questions underlying the 14.3%, but we feel that the focus should be on the reciprocal, the 85.7% … and especially the 13.9%. Where they live and what they do – the intersections of those planes will have far more to do with inflation.

Read More Here.

by Kate Evert | Apr 12, 2018 | Compensation, Diversity, Equity, Inclusion, Salary Budgets, Wage Increases, Work Place

I had no hesitation about becoming a working mother. But reading this article brought back a memory that I must have blocked – until now.

Just about 21 years ago, when awaiting the birth of our first child, I encountered a female partner at the elevator bank. Now given that the Partner-in-Charge of our National group practice was a mother, the Partner-in-Charge of our Chicago practice was a mother, and I had two supportive bosses who were both fathers, I was not unduly worried about becoming a working mother.

Imagine my surprise when this female partner asked me how was I going to “manage coming back to work” after the birth of my child? I thought it was the oddest of questions to ask in our practice area, but despite my surprise, answered her anyway. So imagine my shock when she responded, “Well I sure hope your husband makes a lot of money; that will be expensive.” Now given that we worked in Global Human Resources Solutions, this response was so wrong on so many levels. But even way back in 1997, I found the notion that my career plans were going to be entirely dependent on the earning power of my husband completely absurd.

Sadly, this article shows that perhaps that notion wasn’t so absurd. Our daughter turns 21 this month. I just hope and pray that this notion changes in time for her. Read More Here

by Kate Evert | Mar 8, 2018 | Compensation, Economy, Wage Increases

“Will I get a raise? How much?” is a question on everyone’s mind at this time of year.

Since January, the press has been full of stories telling everyone to only expect a 3% raise. Well, compensation consultants hate generalities almost as much as statisticians do.

There is a reason that Commonwealth HR Consulting keeps a link to the Atlanta Fed front and center on our resource page. Not only do we think that the Atlanta Fed gets it (using a methodology developed by the San Francisco Fed), but we think this is a wonderful resource for organizations to reference based upon your location(s), labor market(s), and labor force(s).

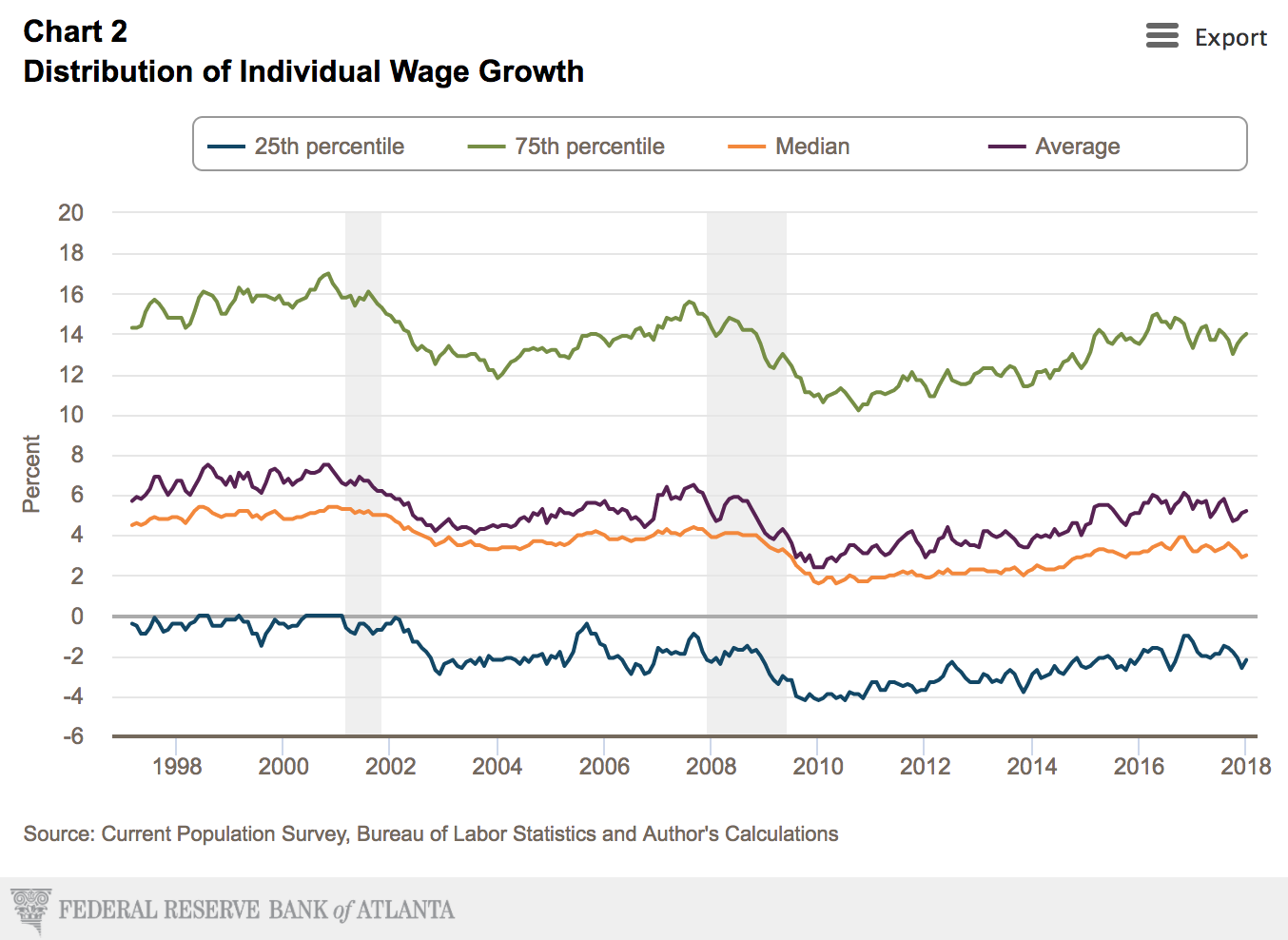

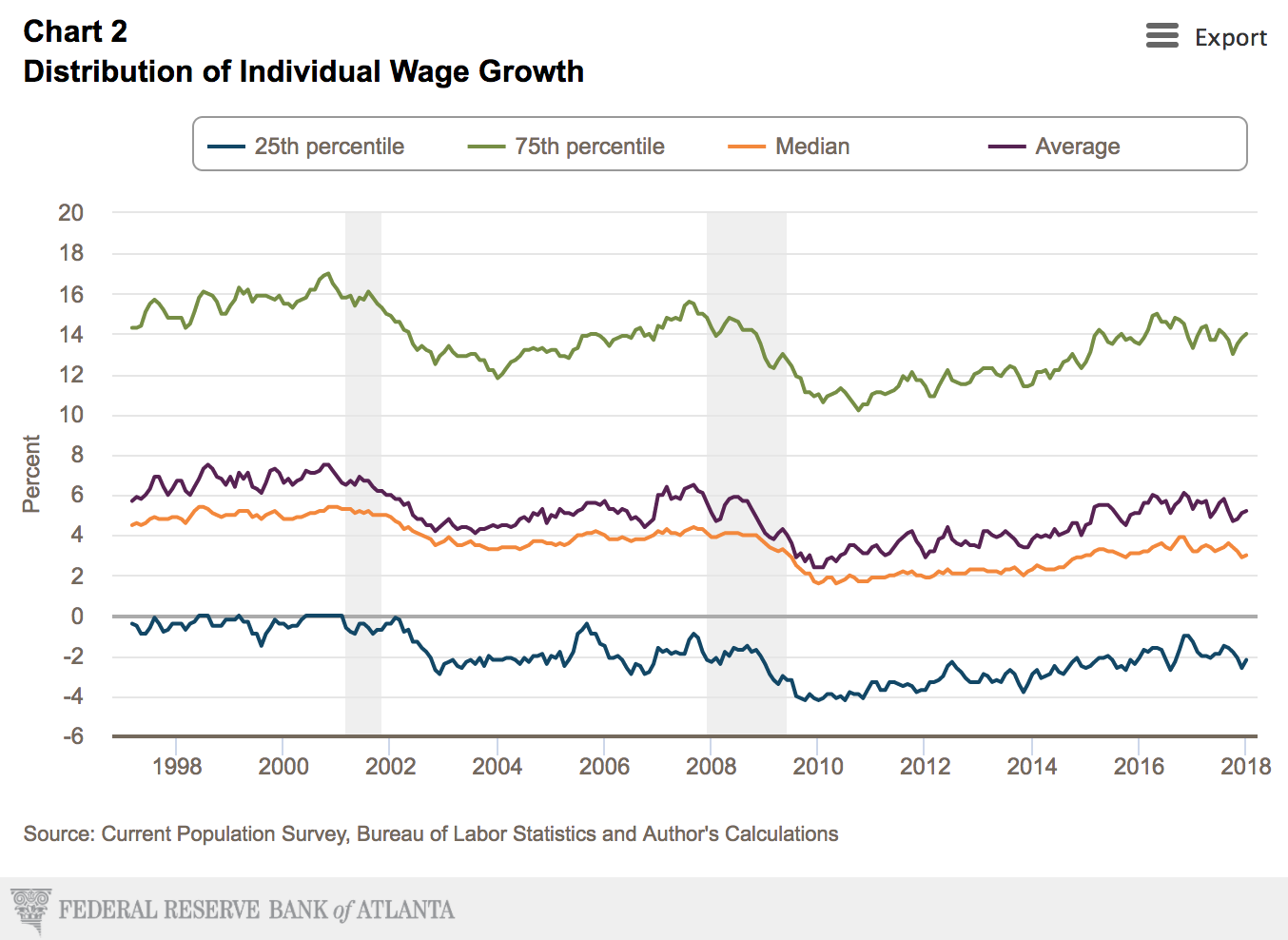

As for that 3.0% increase? We urge you to take a look at Charts 2 and 3 at the Atlanta Fed’s site. In January, the Distribution of Individual Wage Growth showed:

25th Percentile = -2.2%

50th Percentile/Median = 3.0%

Average = 5.2%

75th Percentile = 14.0%

Chart 3 indicates that 14.9% of the group that the Fed tracks, received a 0% increase.

Some food for thought. Especially if you are an employer who is consistently giving increases to employees who have not upgraded their skills in years … and at the same pace as those employees who possess hot skills, the 14% hot skills. Read More Here

by Kate Evert | Nov 16, 2017 | Compensation, Economy, Wage Increases

[vc_row][vc_column][vc_column_text]

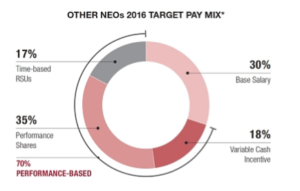

On their earnings call recently, Equifax announced that due to their recent cyber breach, the executive team would be foregoing any annual incentive this

year. Read More Here. “Well that’s good I thought. About time some executives owned up, felt the pain, …” But then this little voice in me wondered … how much pain are they really going to be feeling? Is this for real, or just a good story? So I did what any good compensation consultant would do:

I read their proxy.

It turns out that this noble act isn’t necessarily as noble as it first sounded. First, in their comp design, the target annual incentive comprises only 18% of the Target Pay Mix for the Named Executive Officers. Then, if the 2017 plan follows the design of the 2016 plan, 15% of the annual incentive plan is tied to Corporate Operating Revenue and 65% is tied to Corporate Adjusted EPS. Something tells me that the chances of Corporate Operating Revenue meeting expectations this year aren’t very good. And as for Corporate Adjusted EPS,

which they footnote is a non-GAAP financial measure, well why that is a questionable measure in an annual incentive plan is a blog for another day.

Read More Here.

by Kate Evert | Aug 30, 2017 | Economy, Labor Markets, Wage Increases

Figuring out what’s been going on with wage growth has been one big game of Clue. Economists have been scratching their heads trying to solve the mystery. It seems that the San Francisco Fed has focused their magnifying glass on the right things and solved the Who Done It.

The issue is that Mrs. White (remember her?) and her other Baby Boomer friends are retiring. That knife of hers has sliced nearly a full percentage point off of the growth in median weekly earnings, from 5.2% to 4.2%, on an annual basis.

Retirees being replaced by less expensive workers isn’t new; it’s always happened. It is just so much more pronounced with approximately 10,000 or so Baby Boomers (The Silver Tsunami) daily exiting the work force. Read More Here and Here