COLA

There’s a word that compensation consultants of a more recent era have shunned for at least two decades: COLA

And not in favor of the unCola – in favor of NO COLA.

In fact, the consultants at CHRC have spent a fair amount of time explaining the differences between

Merit Budgets

and

COLA – Cost of Living Adjustments

Until their faces turn an unattractive shade of blue.

The phrase that gets economists animated is “wage-price spiral” … and many are turning an unattractive shade of red believing that the current wage increases are going to take the U.S. to the kind of wage-price spiral that the U.S. economy experienced in the 1970s.

So much to our delight, last week Mitchell Hartman on Marketplace did a story that featured the COLA that we don’t like to imbibe. More importantly, in addition to economists that are convinced we are headed for the spiral, he featured two that pointed out key distinctions of what separates the current situation from that in the 1970s.

Ross Mayfield of Baird points out that unlike the 1970s, the worker’s demands aren’t driving inflation, supply constraints caused by the war in Ukraine and Covid are. Economist Joe Brusuelas underscores the statistic that undergirds Mr. Mayfield’s point:

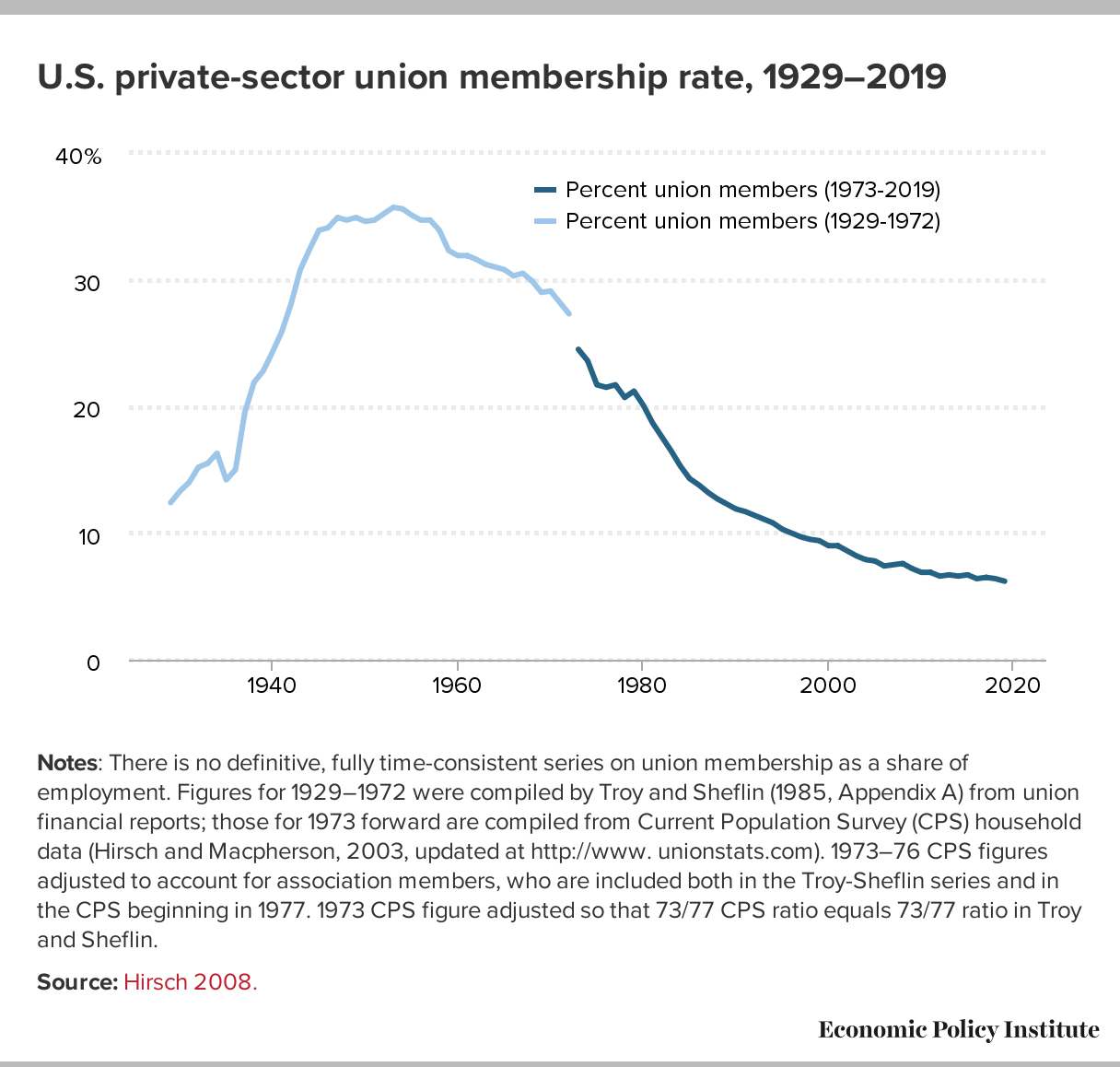

“At that time, labor unions represented approximately 1 in 4 American workers.”

Why were those COLAs so worrisome? They were built right into those union contracts for years at a time, regardless of market conditions. That was a very large factor in the wage-price spiral

How many Americans belong to a union right now?

Charting a Course

Recently, sitting on deck on a gloriously sunny day, gazing across the beautifully calm water, my mind wandered back to grade school math. Probably the grade school math we all dreaded the most: the story problem.

Why?

Because it dawned on me that the captain probably didn’t have to do much of that story problem math that day. You remember the problem: a boat must cross a river Y wide, the current is traveling at X, how does Timmy aim his boat to reach the dock on the other side?

Why did we all hate these sorts of problems so much? Perhaps because in the diagram, or in life, we were always so sure about where that dock was on the other side. Both sides were stationary, we were sure of where they were. But a moving body of water? A current that could change speed, or course, or pull you under without warning? And what if you did all the math, and then somewhere in the middle of the crossing, it all changed?

Upon reflection, those story problems were great preparation for life. They made us weed through the words for the pertinent facts. How often were we reminded to go back and use our solutions to check our work? These problems reinforced that things were not static; they would not remain in place. We needed to reassess, recalculate, and rethink.

Solution?

In today’s current labor markets – and yes there are many, even in one location – the currents are irregular indeed. Many skippers are scared to undertake a journey of understanding, to even test the waters, but test them you must. Maybe your Great Resignation won’t be because of compensation, maybe it will be because of limited career growth opportunities within your organization, or lack of flexible work arrangements. Maybe your compensation is just fine near the shore, but away from the shore, the currents have shifted suddenly, and you haven’t ventured out that way to investigate? Your organization needs to know which way the current is flowing.

It is time to solve for X.

Mind the Gap

I had no hesitation about becoming a working mother. But reading this article brought back a memory that I must have blocked – until now.

Just about 21 years ago, when awaiting the birth of our first child, I encountered a female partner at the elevator bank. Now given that the Partner-in-Charge of our National group practice was a mother, the Partner-in-Charge of our Chicago practice was a mother, and I had two supportive bosses who were both fathers, I was not unduly worried about becoming a working mother.

Imagine my surprise when this female partner asked me how was I going to “manage coming back to work” after the birth of my child? I thought it was the oddest of questions to ask in our practice area, but despite my surprise, answered her anyway. So imagine my shock when she responded, “Well I sure hope your husband makes a lot of money; that will be expensive.” Now given that we worked in Global Human Resources Solutions, this response was so wrong on so many levels. But even way back in 1997, I found the notion that my career plans were going to be entirely dependent on the earning power of my husband completely absurd.

Sadly, this article shows that perhaps that notion wasn’t so absurd. Our daughter turns 21 this month. I just hope and pray that this notion changes in time for her. Read More Here

The Atlanta Fed Gets It

I am sure we sound like a broken record when it comes to AVERAGE wage growth. We’ve pointed out that as Baby Boomers retire at high salaries, and young people enter the labor market at low salaries, of course the average will be lower. We’ve worried that salary budgets of 3.0% meant to cover all range of employees – whether they are in “hot” geographical areas or possess scarce skills – leads to companies making poor merit increase decisions.

The Atlanta Fed has figured out a methodology of looking at wage growth that measures the growth of wages for those that stay in jobs, therefore measuring income growth for non-job changers. The Wage Growth Tracker is the time series of the median wage growth of matched individuals. This is not the same as growth in the median wage.

But Look at Charts 2 and 3. You may have learned in stats class that the median is important because it strips out the noise at the top and the bottom. But this time look at the noise! Follow the 25th and 75th percentiles in Chart 2 to see the tops and the bottoms. See that some workers are receiving 14% or 15% increases and ask yourself: do I have any employees that fit that profile? If I do – how can I address that? Then look at the 25th percentile and ask about what is happening with the negative increases? What competitive factors are driving that?

Lastly, drop to the bottom chart. That’s the percentage of workers receiving 0% increase. Another big why? Are companies diverting that small pool to the 14%? Is there a failure to invest in skills?

We do not have all the answers, but we hope we have framed the questions that folks should be asking. Read More Here